The rapid growth of the solar and renewable energy market has presented some challenges for the United States electrical grid, which will need to grow and adapt in order to facilitate these technologies. One of the issues that solar faces as a primary energy source

The current regulatory framework for energy storage across the US is fairly disjointed, depending largely on independent system operators/regional transmission operators (ISO/RSOs). While the Federal Energy Regulatory Commission (FERC) oversees country-wide regulations, ISO/RSOs in each market host varying rules. The current system would greatly benefit from a more unified market design in order to simplify the integration of energy storage tech with solar and other renewable energy sources.

The Benefits of Energy Storage for Solar

Energy storage is a crucial factor in the future of solar energy, and one that has only recently come into the spotlight. Seeing as solar is not a constant energy source, storage projects can smooth out supply and make solar a more flexible and reliable replacement to fossil fuels.

Response speed is another factor that is sometimes overlooked. Compared to fossil fuels, energy storage systems can discharge power much more rapidly to the grid. A solar plus storage project can be the perfect solution for a municipality suffering from frequent brownouts and shortages, even if the area is not quite ready to fully depend on renewable energy.

Energy storage becomes even more valuable the further a business or community is located from the main grid, especially when said area is prone to disruption and line issues. A state like California, for example, could use storage facilities to eliminate the need for vast lengths of power lines through dry forested areas, significantly lowering the risk of wildfires.

Who is Currently Using Storage?

Many states are beginning to seriously utilize renewable storage, including California, Hawaii, New York, and Massachusetts. Utilities and regulators are becoming aware of the massive benefits to respective grids when a storage project is paired with solar.

The latest to join this group is Arizona, which recently issued a request for proposals to build 106 MW of storage (to be completed by June 2020). These facilities will help shift its power plants output from daytime to evening when the ability to meet demand is usually stressed.

Since 2011, installed power capacity has nearly doubled across the nation every two years, with 708 MW currently in operation. Eastern states currently host the most installed power capacity, although California is quickly catching up. The image below from a U.S. Energy Information Administration report shows the regional allocation of installed storage projects as of 2017.

The report states:

“Between 2003 and 2017, 734 MW of large-scale battery storage power capacity was installed in the United States, two-thirds of which was installed in the past three years. Nearly 40% of existing large- scale battery storage power capacity lies in the PJM Interconnection, shown in Figure 2. In 2012, PJM created a new frequency regulation market for fast-responding resources, the conditions of which were especially favorable for battery storage.”

Market and Policy Drivers

Battery storage is capable of serving multiple applications, with benefits for more than one participant in the system, such as consumers, transmission system operators and generation resources. The actual ability of storage to provide those services is often poorly defined in existing market rules, however, some regions have improved in how they finance, procure and operate storage installations.

Wholesale Market Rules

The U.S. Energy Information Administration defines ISOs/RTOs as “independent, federally-regulated non-profit organizations that ensure reliability and optimize supply and demand bids for wholesale electric power”. According to the U.S. Energy Information Administration’s May 2018 report:

“They are technology neutral and must ensure market rules do not unfairly preclude any resources from participating, as enforced by the Federal Energy Regulatory Commission (FERC). Many existing market rules may not take into account the unique operating parameters and physical constraints of battery storage as both a consumer and producer of electricity. However, recent actions by FERC ISOs/RTOs have begun to carve a path for storage to participate in their markets.

A notable example is FERC Order 755, issued in 2011, which required ISO/RTO markets to provide compensation to resources having the ability to provide faster-ramping frequency regulation. As a result of Order 755, PJM split its frequency regulation market into two services: a fast-ramping service and a slower-ramping service. By the end of 2015, more than 180 MW of large-scale battery storage capacity had come online in the PJM territory. However, PJM began observing operational issues in its frequency regulation market structure and has since changed its frequency regulation signals.

Installations of large- scale battery storage in the region have plateaued since PJM made these changes.”

State-Level Policy Actions

Federal policies surrounding energy storage have been limited thus far, with most policy activity occurring at the state level, including the establishment of incentives, setting procurement mandates and requiring storage to be included in long-term planning.

California Policy

By far the leader in energy storage measures to date, California implemented Assembly Bill 2514 in 2013, setting a mandate that local investor-owned utilities produce 1,325 MW of energy storage by 2020, to be operational by 2024. The Self-Generation Incentive Program designated $48.5 million in residential storage rebates for systems 10 kW or smaller, and $329.5 million for storage systems larger than 10 kW.

Many of these changes were spurred by the Aliso Canyon facility leak, as lawmakers in the state moved to cut dependency on natural gas as quickly as possible. In May 2016, the California Public Utility Commission (CPUC) authorized the Southern California Edison electric utility to expedite solicitation for energy storage, adding 62 MW of battery storage capacity to the system.

Other States

To date, three states besides California have issued energy storage mandates and targets: Oregon, Massachusetts, and New York. Some states have also provided financial incentives for storage, including grants, tax incentives and support for test projects. Maryland began offering a 30% tax credit in 2018 for all installed costs for residential and commercial storage projects.

Several states have begun requiring utilities to create integrated resource plans to utilize a mix of generation and transmission, with some now requiring storage to be included. Storage is often a challenge to include in these plans due to the unique constraints around it, such as the fact that it can be interconnected at multiple points throughout the system and serve a variety of applications.

The Future of Energy Storage

Advancements in energy storage technology will likely break down many of the current barriers to adoption. Cost is one of the biggest issues, but as state and federal policies are improved to better define the benefits and monetary value of storage, the number of incentives and rebates are likely to increase substantially.

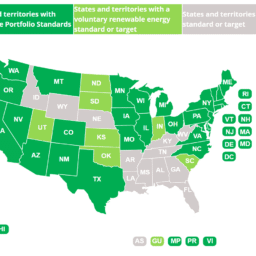

A few states now recognize storage tech as renewable generation through their Renewable Energy Standards (RES), while other states now award Renewable Energy Credits (REC) toward energy generated from storage devices charged with renewables.

UCUSA writes in their Feb 2015 article:

“The Federal Energy Regulatory Commission (FERC), the agency that regulates the electricity grid, has created a pricing structure that pays storage technologies and other fast-ramping resources a higher price for their services. This pricing structure, called Pay-for-Performance, recognizes the value of rapid response in providing stability to the grid. Pay-for-Performance has the potential to make storage technologies more cost-effective on a commercial-scale. An investment tax credit (ITC) would also help accelerate the deployment of storage technologies.”

How SCF Can Assist with Storage Projects

Sustainable Capital Finance is active in behind-the-meter & small utility, solar storage applications, and is able to provide valuable assistance in the development of these projects. Please contact us today to discuss your project.