The Federal Tax Credit for Solar Photovoltaics, commonly referred to as the Investment Tax Credit (ITC), has been one of the most crucial pieces of legislation supporting the United States solar industry since its inception in 2006.

When President Biden signed the Inflation Reduction Act into law on August 16, 2022, several major changes came into effect that will have a greatly positive impact on commercial solar pipelines over the next decade:

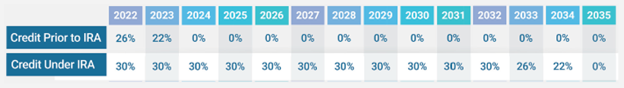

- Both the timeline and rebate percentages of the ITC have been extended, meaning PV systems installed between 2022 and 2032 will provide a 30% tax credit. This will decrease to 26% for all systems installed in 2033, and will be reduced to 22% in 2034. Systems already installed in 2022 will see their tax credits increased from 22% to 30% if they have not yet been claimed.

- Solar+storage equipment expenses have been expanded, now including energy storage devices with a capacity rating of 3 kilowatt hours or more. Storage alone is also included in the ITC, however it is best paired alongside solar energy.

This powerful commercial solar incentive can be an excellent tool for commercial entities to lower their tax liability, however without a financing mechanism such as a power purchase agreement, they will still face upfront costs. Non-profit organizations, as well as religious institutions and schools, stand to benefit even further from a solar power purchase agreement, or PPA, due to their inability to monetize the associated tax benefits from the ITC.

How Does the Solar Investment Tax Credit Work?

According to SEIA:

The Investment Tax Credit (ITC) is currently a 30 percent federal tax credit claimed against the tax liability of residential (under Section 25D) and commercial and utility (under Section 48) investors in solar energy property. The Section 25D residential ITC allows the homeowner to apply the credit to his/her personal income taxes. This credit is used when homeowners purchase solar systems and have them installed on their homes. In the case of the Section 48 credit, the business that installs, develops and/or finances the project claims the credit.

These tax credits result in a reduced income tax for the entity installing solar, depending on the amount of solar constructed. The following chart from SEIA illustrates how these credits would be applied under current law, as well as their application following the Inflation Reduction Act:

According to SEIA:

Commercial and utility-scale projects which have commenced construction before December 31, 2023 may still qualify for the 26 or 22 percent ITC if they are placed in service before January 1, 2026. The IRS issued guidance (Notice 2018-59) on June 22, 2018 that explains the requirements that a taxpayer must meet to establish that construction of a qualified solar facility has begun for purposes of claiming the ITC.

How to make use of the ITC for your business or clients

The O&A team at Sustainable Capital Finance can help to provide guidance on how your organization, or your clients organization, can make the best use of the solar ITC extension, by providing information on other potential local incentives or rebates. Our team is highly knowledgeable on any potential programs in solar-friendly states such as California, Arizona, Massachusetts, Illinois and many more, and can guide you or your clients toward the best solution to maximize savings through the use of solar, solar+storage, or solar+storage+ev charging.

To learn more about utilizing a solar power purchase agreement, or to chat with our team about a potential project, simply fill out our web form or contact our O&A team today at origination@scf.com.