California gas and power giant PG&E is officially filing for chapter 11 bankruptcy after equipment malfunctions started a series of devastating wildfires, including the Tubbs and Camp fires. This move could help the utility avoid billions in damages while they restructure, as a means to prioritize paying shareholders before settling customer lawsuits. The company claims on its website: “we are NOT going out of business.”, although, there are many questions as to whether they will continue to honor their longstanding wind and solar contracts during this process.

California gas and power giant PG&E is officially filing for chapter 11 bankruptcy after equipment malfunctions started a series of devastating wildfires, including the Tubbs and Camp fires. This move could help the utility avoid billions in damages while they restructure, as a means to prioritize paying shareholders before settling customer lawsuits. The company claims on its website: “we are NOT going out of business.”, although, there are many questions as to whether they will continue to honor their longstanding wind and solar contracts during this process.

Most legal experts agree that PG&E’s bankruptcy filing is a defensive& voluntary move to buy time and consolidate its claims into a single case. If PG&E does end up walking away from old contracts, it could potentially be devastating for renewable energy suppliers. In this scenario, contracts with PG&E would need to be renegotiated at a rate indicative of the current market. Alternatively, renewable energy suppliers could search for new buyers such as a competing utility, although again they would be negotiating at current lower rates. Many solar farms will likely be forced to rely on loans or state assistance in the short term if PG&E stops paying, however, there may be some positive change to come from this fiasco.

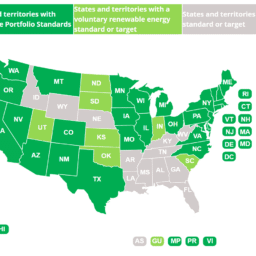

California lawmakers now find themselves faced with several tough choices, as any negative impact on the solar industry from these proceedings will hurt the state’s aggressive clean energy milestones. There may be a push back against PG&E renegotiating its contracts, as solar providers have requested the Federal Energy Regulatory Commission (FERC) to order existing PPAs kept in place to meet the FERC’s “public interest” standard. Given the recent legislation pushing for net zero emissions standards, this would likely be an attractive outcome for many politicians.

Another point to consider is that distributed generation solar installations, such as at a school or business with a parking lot or roof array, can eliminate the need for long runs of power lines. These long stretches of cable are often the culprit in sparking blazes such as the Camp fire, so when facilities can power themselves with onsite generation, the need for lengths of hazardous cabling is minimized. Other utilities, as well as PG&E themselves, are undoubtedly aware of this and will be looking to fund a safer infrastructure in any way possible going forward.

The final silver lining for existing or potential solar PPA owners is that savings will likely skyrocket in the short-term as a result of PG&E’s financial troubles. The utility will almost certainly turn to rate hikes for its customers as they try to save themselves, meaning the net benefit from solar will only continue to grow. No industry is free from risk, but there is a strong possibility that the solar industry will exit the California wildfires stronger than ever, as solar continues to stand out as one of the safest options available.

SCF offers a variety of PPA and Takeout financing options for commercial and industrial solar projects and can provide valuable assistance for developers or EPCs looking to navigate the under-served C&I market.

Contact SCF today to discuss potential terms for your solar project.