Shiraz Madan, CEO, Sustainable Capital Finance

Shiraz began his professional career working for LaSalle Bank/ ABM AMRO in the Chicago Financial District. He served as a credit analyst and commercial banker for middle market to large corporate clients. Shiraz left the banking world and became a shareholder and Vice President at SEO Design Solutions (SDS); a startup specializing in search engine optimization and internet marketing, located on the “Magnificent Mile” in Chicago. Shiraz was responsible for business development and managing access to the capital markets, working with SDS’ investor base. Shiraz was appointed as the Chief Executive Officer where he successfully grew the company’s profits..

Shiraz decided to rejoin the financial and startup worlds and founded SCF. With experience in project finance and access to the capital markets, Shiraz partnered with Dan Holloway and DV Patel to form the necessary foundation for launching a successful solar finance company.

As the CEO, Shiraz currently serves as the primary communicator, decision maker, leader, and manager.

Shiraz holds a BA in Business Management from Millikin University.

Stratton Report: Please briefly describe how Sustainable Capital Finance (SCF) is playing in the behind-the-meter C&I market.

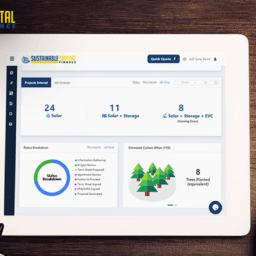

Shiraz Madan: SCF is a third party financier of commercial and industrial, municipal, school and non-profit projects. We work with EPCs who are looking for a PPA provider to finance their solar  projects and we work with developers who are looking for a takeout partner to acquire solar projects either during development or construction. We’re unique in our approach to C&I in that we’re able to offer solutions for projects as small as a 100kW and we’re very comfortable with unrated offtakers. With these two segments being significantly underserved, we’ve been committed to being the solution for our partners for these segments. The way we deliver our third-party financing service to our partners is through our proprietary cloud-based software called the SCF Suite. The Suite allows our partners to price projects in real time, upload project-level data in a centralized place, upload all project files such as drawings, agreements, permits, financial statements, etc. It allows our partners to auto-populate counterparty agreements such as term sheets, PPAs, and EPC agreements. Overall, it’s proven to be a comprehensive tool that streamlines the origination, development, financing, and construction process for our partners and internally for SCF and it has allowed us to bring capital to the small C&I sector.

projects and we work with developers who are looking for a takeout partner to acquire solar projects either during development or construction. We’re unique in our approach to C&I in that we’re able to offer solutions for projects as small as a 100kW and we’re very comfortable with unrated offtakers. With these two segments being significantly underserved, we’ve been committed to being the solution for our partners for these segments. The way we deliver our third-party financing service to our partners is through our proprietary cloud-based software called the SCF Suite. The Suite allows our partners to price projects in real time, upload project-level data in a centralized place, upload all project files such as drawings, agreements, permits, financial statements, etc. It allows our partners to auto-populate counterparty agreements such as term sheets, PPAs, and EPC agreements. Overall, it’s proven to be a comprehensive tool that streamlines the origination, development, financing, and construction process for our partners and internally for SCF and it has allowed us to bring capital to the small C&I sector.

SR: For this market, what business models and strategies are you seeing market players deploying now and what is the rationale for it?

SM: The C&I market has seen a great increase in new business models and strategies recently. On the distributed side, we’re seeing software play a huge role in creating efficiencies for developers and installers. From sales and design software like Aurora and HelioScope to Energy Tool Base for rate schedule access and cost avoidance calculation to GELI and Homer on the storage side. The use of these platforms, and our very own SCF Suite, has lowered the barrier to entry for installers and developers and has paved the way for scalability. With regards to community solar, we continue to see an increased presence in the market. With regulatory support, we’ll likely see additional states adopt the community solar approach which will include a blend of C&I and residential customer subscriptions. On the finance side, new capital has entered the solar C&I sector from institutional investors looking for returns that are unattainable in utility or residential. This has resulted in smaller developers having access to development capital and thereby have the ability to originate and develop portfolios of projects for takeout partners like ourselves.

SR: How do you see the market landscape shaping up in the future— a consolidation of players? Still fragmented with lots of smaller, local players? A market dominated by utilities with existing customer relations? Something else?

SM: With the residential market being so saturated, opportunities have opened up for smaller EPCs and developers to enter this small commercial sector. As mentioned previously, with enough scale, these parties can obtain development capital and continue to build portfolios for takeout partners. We really enjoy working with partners that are new to C&I as it’s presumably a part of their growth process and it’s exciting to grow with them. Having said that, with so many smaller developers entering the fray and new capital in the mix, it is and continues to be a very fragmented marketplace and I think we will see strategic acquisition from larger solar entities and from investors that are looking to own platforms and assets as opposed to simply buying assets. With regards to utilities dominating the market, since most utilities are not fully tax efficient, I don’t think we’ll see them dominate the market place until the ITC steps down and is marginalized or eliminated. They have an inherent low cost of capital which is definitely advantageous so we’ll continue to see them participating and I think we’ll see that participation growth in C&I as well.

SR: How is the U.S. 201 solar trade case currently impacting the market?

SM: We’ve seen two major current impacts. The first being module availability with the punitive uncertainty of the looming tariffs. Sponsors and investors have gobbled up inventory from most tier 1 manufacturers. We fall into this category as we’ve also secured modules to assist our development partners fulfill their pipeline. The second current impact is a reluctance of developers and financiers to engage in new projects that aren’t supported by existing inventory. Essentially not wanting to take tariff risk.

SR: If tariffs are imposed, how do you think that will that impact the market in future?

SM: It really depends on how punitive the tariff is. If the administration is interested in the aesthetics of the tariff and the potential for Americans to view the tariff as sticking up for American labor then we may see a 20% to 40% tariff which isn’t ideal but it’s also not a backbreaker for the industry. If the administration is interested in significantly penalizing manufacturers, the US solar industry would take a big hit. Thousands of jobs will be lost and all the positive momentum that has been gained over the years will be lost. Let’s hope it’s the former and not the latter.

SR: Do you see or expect to see a shift to more systems purchases rather than PPAs in this market?

SM: Under the current capital landscape and ITC window, I don’t. With an influx of capital in the marketplace we have seen margin compression and simply more PPA options. In a rising interest rate environment with an ITC step down or elimination then yes, I do think we will see an increase in system purchases relative to PPAs, as investors will look elsewhere for returns.

SR: Is the flow of tax equity into the market sufficient to meet the demand?

SM: With so many buyers scouring their networks for projects that will reach commercial operation in 2017, I would say there’s definitely a healthy amount of tax efficient capital in the marketplace currently. Now where that capital is being deployed might be a little saturated with utility, large-scale C&I and residential garnering the large majority of it. With small C&I, there are only a few tax efficient capital sources available.

SR: Creditworthiness has been an ongoing challenge in this market. Do you see any solutions developing to tackle this challenge?

SM: We definitely agree that the unrated sector of the market has been drastically underserved for years and due to its size has huge potential for Behind-the-Meter solar. There are two general approaches to credit; 1) Pricing credit risk into projects, and 2) Mitigation through off-taker contractual obligations.

Through our software, the SCF Suite and in conjunction with the use of Moody’s RiskCalc, we’ve developed a credit rating system that can be utilized in real time. With data from an off taker’s financial statements, a credit rating can be obtained within our software as well as an indication of whether we view the off taker as an investment grade party. Now this system and methodology has allowed us quantify credit risk, price that risk into our projects, and ultimately bring capital to the C&I sector.

Another approach would be to insure against off-taker default. These products are relatively new and can be cost-effective in some instances, but the market isn’t fully developed yet.

I think the key for the marketplace as a whole is to take a view on credit using a rational benchmark. Whether that benchmark is Moody’s or another analytic, making assumption on a probability of default and price it into the project. Insurance is certainly a viable alternative, as long as it’ cost effective. With more insurance products available, this approach will take-off. Either way, I think pricing our perceived risk into a project or obtaining insurance, is a much better way to address credit concerns as opposed to requiring a letter of credit, or including financial convnants in a PPA.

SR: If we get a tax reform, what is an impact you see happening to the market?

SM: It really depends on what level of tax reform is effectuated. If we see a major tax reform on corporate taxes, it could very well reduce the available supply of tax equity in the marketplace and thereby an increase in the cost of tax equity capital. If reform is minor, which is likely given the lack of party cohesion, we might see a slight decrease in the supply of tax equity capital and a slight increase in the cost of tax equity capital. Now all of this assumes that there isn’t a large influx of new tax equity capital into the marketplace which I don’t think is accurate. I think we will see new tax equity investors enter the marketplace and offset some of the impact of potential tax reform.

About Sustainable Capital Finance: Sustainable Capital Finance (SCF) is a third party financier & owner/operator of commercial & industrial (C&I) solar assets and is comprised of experts that specialize in structured finance and solar development. SCF has a vast network of EPCs and Developers across the US that submit project development opportunities through SCF’s cloud-based platform, the “SCF Suite”. This allows SCF to acquire and develop early to mid-stage C&I solar projects, while aggregating them into large portfolios.

SCF has standardized the diligence and transaction process, thus creating cost-efficiencies and risk mitigation, in order to solidify the C&I marketplace as an investment-worthy asset class. For more information, visit https://scf.com. Connect with us on Twitter at @SCF_News and follow us on Linkedin and Facebook!

About Stratton Report: As the power industry develops new business models, Stratton Report is there with news and analysis of deals, developments, trends and innovations. Our coverage provides you with the insights of today’s top industry thought leaders and key industry players. Wherever something new exciting and different is being tried in the world of electric power, you’ll find us asking questions, providing answers, and connecting you to the people you’ll need to succeed in this ever-changing industry. For more information, visit www.strattonreport.com.

This interview was original published here by Stratton Report and was republished with permission.