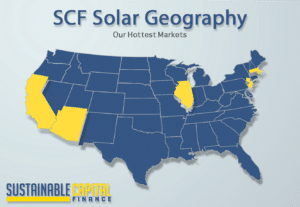

Since it is June, the 6th month of the year, we wanted to present you with our thoughts on the six hottest markets for solar financing in the country. If you have questions or thoughts on these markets or any others not listed, don’t hesitate to reach out to Dan Holloway @ Dholloway@scf.com or Joel Binstock @ jbinstock@scf.com

1) California: California is the most developed and saturated solar market in the United States. In 2016, approximately 10% of all energy produced in-state was from solar generation. With $0.15+ per kwh rates, utilities with experience working with solar developers, and ample sunshine California will continue to deploy solar at a substantial clip going forward, particularly in the C&I and community solar markets.

2) Massachusetts: Out with the old, in with the new. Massachusetts has begun to phase out their SREC II Carve-out program and replace it with the new and improved SMART program. SMART is expected to be one of the most attractive solar programs in the country in 2018 & 2019 with significant available capacity to be deployed. Read more about the SMART program and SCF’s SMART offering here!

3) Illinois: Illinois, much like Massachusetts has decided against pursuing a traditional SREC Program to achieve its RPS standards. Instead, it has established the Adjustable Block Program (AB Program) which offers fixed incentives over 5 years in order to encourage solar deployment. The AB program is still in its early stages but anticipated opening is Q4 2018 or early 2019. One thing to note here is that while the Community Renewable Generation category is substantially oversubscribed (some have said by as much as 500% or more), the Distributed Renewable Generation category (2 MW and less) is still relatively unsubscribed. You can read more about it from SCF here!